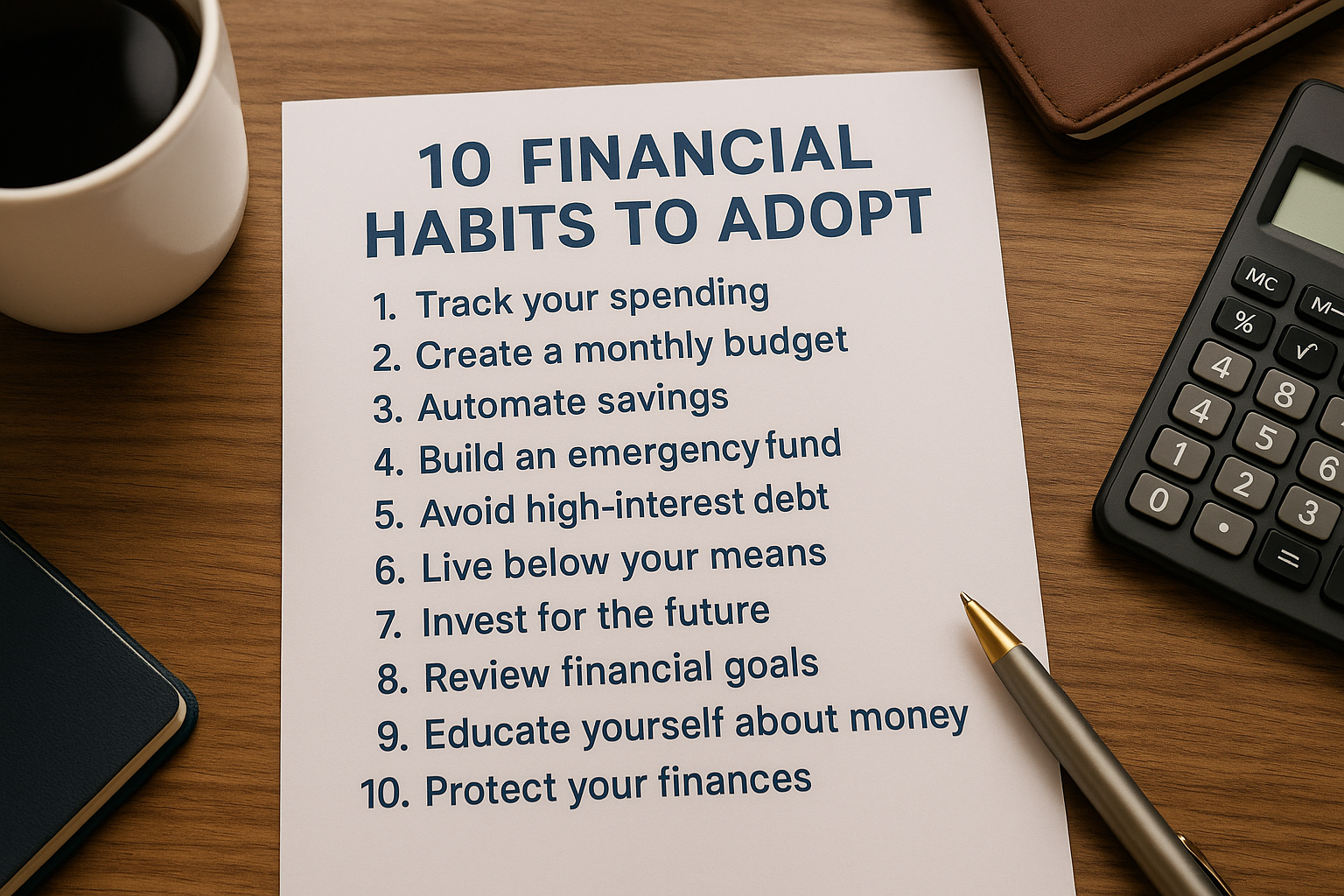

Developing healthy financial habits is one of the most important steps toward achieving long-term financial stability and success. Whether your goal is to save more, eliminate debt, or invest for the future, the right daily habits can make a significant difference. Here are ten essential financial habits everyone should adopt.

1. Track Your Spending Regularly

If you don’t know where your money goes, it’s impossible to control it. Make it a habit to track your spending daily or weekly.

How to Do It:

- Use apps like Mint, YNAB, or PocketGuard.

- Keep a spending journal.

- Review your bank and credit card statements frequently.

Understanding your spending patterns helps you identify unnecessary expenses and improve decision-making.

2. Create and Follow a Monthly Budget

A budget is the foundation of financial control. It ensures that you spend less than you earn while allocating money for savings and investments.

Tips for Budgeting:

- Use the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt).

- Adjust percentages according to your goals.

- Review and update your budget monthly.

A good budget is flexible but consistent.

3. Automate Savings

“Pay yourself first” is a golden rule in personal finance. Set up automatic transfers to your savings account before you spend anything.

Why It Works:

- You save without thinking about it.

- It builds discipline passively.

- It reduces the temptation to spend money unnecessarily.

Even starting with a small amount each month will add up over time.

4. Build an Emergency Fund

An emergency fund prevents financial disasters when unexpected events happen — medical bills, car repairs, job loss, etc.

How Much Should You Save?

- Start with $1,000 as a mini emergency fund.

- Then aim for 3–6 months of essential living expenses.

Keep this money in a separate, easily accessible savings account.

5. Avoid High-Interest Debt

Debt with high interest, like credit cards and payday loans, can drain your financial progress.

Best Practices:

- Pay credit card balances in full every month.

- Avoid payday loans entirely.

- If you have high-interest debt, prioritize paying it off before investing.

6. Live Below Your Means

Spending less than you earn is the most fundamental financial habit.

How to Achieve This:

- Differentiate between needs and wants.

- Delay gratification — avoid impulse purchases.

- Opt for used or discounted items when possible.

Living below your means creates room for saving, investing, and future opportunities.

7. Invest for the Future

While saving is important for short-term needs, investing grows your wealth long-term thanks to compound interest.

Start With:

- Index funds and ETFs for diversification.

- Retirement accounts like 401(k) or IRA.

- Robo-advisors if you prefer automated investing.

The key is to start early and invest consistently.

8. Review Your Financial Goals Regularly

Goals keep you focused and motivated.

Steps to Maintain This Habit:

- Set short-term, medium-term, and long-term goals.

- Review progress monthly or quarterly.

- Adjust goals based on life changes.

Examples include buying a house, retiring early, or funding education.

9. Educate Yourself About Money

Financial literacy is an ongoing process. The more you know, the better decisions you make.

Ways to Learn:

- Read finance blogs, books, and articles.

- Listen to financial podcasts.

- Attend webinars or workshops.

Recommended books: Rich Dad Poor Dad by Robert Kiyosaki, The Total Money Makeover by Dave Ramsey, and The Millionaire Next Door by Thomas J. Stanley.

10. Protect Your Finances

Financial security goes beyond savings and investing.

Key Protections:

- Insurance: health, car, home, and life.

- Identity protection: monitor credit reports and use strong passwords.

- Estate planning: create a will, assign beneficiaries.

A good protection plan prevents small issues from becoming financial disasters.

The Bottom Line: Small Habits, Big Results

Adopting these financial habits doesn’t require being wealthy. What it requires is discipline, consistency, and a commitment to change. Start small — track your spending, automate a small savings amount, or read one finance book this month. Over time, these small steps will transform your financial life and set you on the path to financial freedom.